Move over Bloomberg Terminal, here comes Gamestonk Terminal

In this blogpost, we introduce Gamestonk Terminal, an open-source project that aims to be a comprehensive tool for financial analysis and stock market research. It includes functionalities for discovering stocks, market sentiment analysis, fundamental and technical analysis, due diligence, prediction techniques, and more.

The open source code is available here.

Hey all,

2 months ago I made a terminal that I had been working on my spare time, to help me on my stock research, open-source. See here.

The motto

Gamestonk Terminal provides a modern Python-based integrated environment for investment research, that allows the average joe retail trader to leverage state-of-the-art Data Science and Machine Learning technologies.

As a modern Python-based environment, Gamestonk Terminal opens access to numerous Python data libraries in Data Science (Pandas, Numpy, Scipy, Jupyter), Machine Learning (Pytorch, Tensorflow, Sklearn, Flair), and Data Acquisition (Beautiful Soup, and numerous third-party APIs).

As of today, and thanks to all your help and the traction created around it, the terminal is looking better than ever. Now it’s no longer only me taking care of the repo, but also 2 other experienced devs, who are adding features on a daily basis and increasing the robustness of the codebase. Feel free to wander through the FEATURES page to see what you would get out of this tool!

If some of you thought it was amazing 2 months ago, you won’t believe what it looks like now. You can check out the ROADMAP for all the features that have been added since, but let me list some of them:

- New Screener for stocks, which allows users to save their presets and share them

- New Options menu

- New Comparison Analysis to compare several tickers in their historical price, sentiment, or fundamental analysis

- New Portfolio Optimisation that assigns stocks weights based on risk level specified by the user

- New Exploratory Data Analysis menu that looks at historical data from a statistic point of view

- New Residual Analysis after using a statistical model for prediction

- New menu to provide access to your portfolio (supports Robinhood, Ally invest, Alpaca, and Degiro)

- New Cryptocurrency, Forex, and FRED menus

- Prediction with backtesting

- Technical analysis that includes a score and a summary

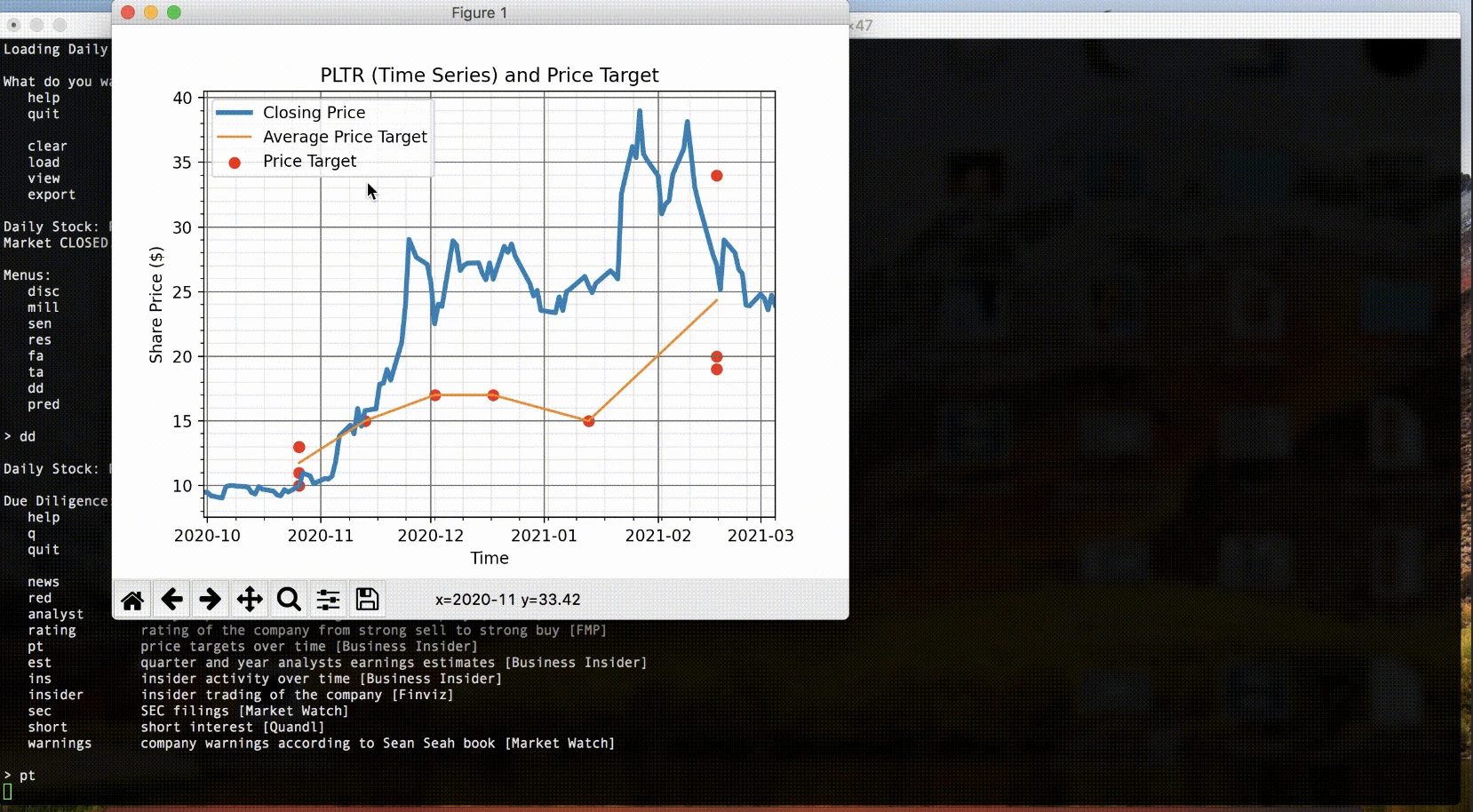

- Due Diligence menu with data from Dark Pools, and also Failure to Deliver

- Sentiment analysis from news provided from collaboration with a company that provides this feature paid. Free for us!

As always feedback is appreciated, and contributions even more so!

Let’s try to reduce the gap between the amount of information that the Hedge Funds have access to in comparison with the usual retail trader.

Bloomberg Terminal, we’re coming for you.

Feel free to join our discord at https://discord.gg/Up2QGbMKHY.