Why AI Will Replace Jobs in Finance and How You Should Prepare

It's not a matter of if, but a matter of when. AI will replace analysts' jobs, and we actually believe that's a good thing. In this blog post, we explain why and how you can prepare for this revolutionary change in the world of finance.

Introduction

This is the current state of Quant/Finance/Investing conferences in 2024

I've heard panels defending both sides: Yes and No.

I think that people who say "No" don't understand how AI fundamentally works, and most people who say "Yes" are understating the impact it will have.

Personally, a much better question is "When will AI replace financial analysts?" or "How can I prepare for the shift?"

History

If we look back at the automotive industry, 100 years ago - this is what a Ford factory looked like:

How many of these blue-collar workers would have said that their jobs would be extinct in less than 100 years? And for the most part, they are.

This is where we are today in terms of AI.

Some tooling (read: AI) can help humans do their job, but it still needs to be supervised.

But with enough time (for the automotive industry that was 100 years), AI will take over.

This is what Tesla's Giga Berlin factory looks like today.

When will AI replace financial analysts?

Bill Gates famously said: "Most people overestimate what they can achieve in a year and underestimate what they can achieve in ten years".

I've found this to be mostly true for everything tech.

EXCEPT AI.

This is why I'm so bullish on the category as a whole.

I subscribe to a few newsletters that share daily AI updates, and it's crazy that every single day there's something big happening. Either a new model is released and open source, a new framework to do RAG or fine-tune, a new company announces they are working on foundational models, a new paper that pushes the field forward, or a new investment from a big corporation.

I mean, even enterprises are rushing to jump into the AI train. Either releasing AI features to millions of users before proper testing (e.g. Gemini overview on Google and the whole Reddit answers), adding AI where it isn't really necessary (e.g. Meta AI on WhatsApp), exploring new monetization opportunities (e.g. Amazon Bedrock for fine-tuning) or risking on their values to not be left behind (e.g. Apple partnering with OpenAI — risking the security brand they worked so hard for).

So, I think this will happen soon.

And it's with that in mind that we have been building OpenBB.

How can I prepare for the shift?

I think that the most important question that financial analysts should ask themselves is not 'when' but 'what can I do to prepare myself for when AI starts taking over'.

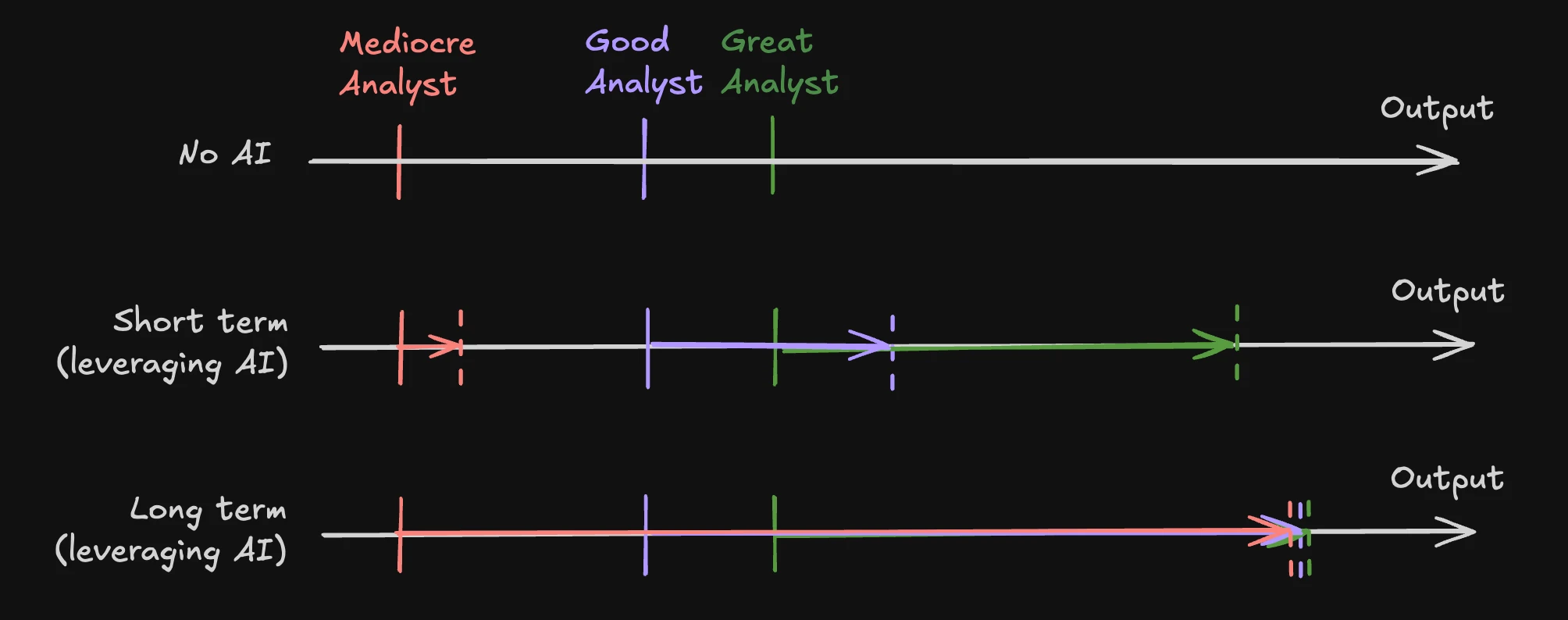

There's going to be multiple stages before AI fully takes over. Here's how I envision it playing out:

(For what it's worth, I think this is equivalent to what will happen to developers in general).

Short term

We are starting to enter this timeline.

A timeline where analysts will use AI to augment their output.

A good analyst using AI will be able to perform at a better level than a great analyst who doesn't use AI.

Interestingly, a mediocre analyst will be able to increase their output but nowhere as much as a good or great analyst. This is because the AI usage will supervised and still "driven" by the analyst (through prompts). So mediocre analysts will not benefit as much because they will either trust too much the AI (without being able to discern its validity), not use the best prompts because they don't know what to use the AI for, or not use the output because they won't comprehend the insights that the AI is generating.

During this period, the gap between mediocre and great analysts will be at an all-time high. This will expose more who is pushing their weight and who isn't.

Another thing is that firms that will be hiring high-talented juniors/interns will start adding AI experience as a requirement (e.g. OpenBB experience) since they understand that they will have a higher leverage and their output will be much better. Potentially even replacing a current analyst with many years of experience that doesn't leverage AI in the day-to-day.

I think there are 2 reasons for this:

-

AI will allow financial analysts to have much broader mandates as they will be able to automate the process of research and screen the best companies. Instead of analyzing 20 companies per quarter, they will do 500.

-

AI will be able to extract trends and patterns that humans simply can't due to the amount of data necessary to process. The amount of data that financial firms use to invest is constantly on the rise, that's where they get their alpha from. Given that an analyst has a limited amount of resources, they will either have to narrow down the companies in their mandate or process less data for each.

Long term

In the long term, AI will start taking the reigns.

This is the equivalent of self-driving cars becoming fully autonomous.

The gap between mediocre and great analysts will narrow over time because AI is doing all the heavy work.

At that time, it will be very hard to distinguish the competency of mediocre and great analysts — the main indicator will be how they interpret/understand the AI model, i.e. how they can explain what led to the AI "deciding" to invest in companies based on hundreds of different datasets.

This is why we spend hours obsessing over the UX of the OpenBB Terminal Pro. We want to make sure analysts know at all times what the AI Copilot is doing and thinking. Because interpretability will be a big topic in the future.

It's important to note that the best analysts will be the ones who have their jobs more secure over time. That is because provided the AI is taking the reigns, when it fully takes the reigns, the output of all analysts will be more or less the same. However, in the period before, the great analyst will have an edge because their skill is still in use and so the leverage lever is bigger.

I think that when AI fully takes over analysts' jobs, the best ones will move towards opening their investment firms and focus on the human part of the job: communication.

Communicating to their investors why they made their decisions, e.g. "We have access to this dataset which others don't, and our AI model correlated that data with x, y, and z which enabled us to invest ahead of the rest of the market". This is the "interpretability" of the AI that I mentioned earlier.

What can you do?

You should still pursue a career in the space.

But you should do so with AI in mind.

Experiment with products out there that leverage AI to make you more efficient (you can try OpenBB for free at pro.openbb.co). You will soon realize that your output can compete with someone who is neglecting AI in their day-to-day.

Being a top financial analyst is still something you should strive for since these are going to be the last to be replaced. And when they are, you will still have an edge because your role is likely to evolve into a communication/management role that explains what the AI is doing to investors. And that would be much easier if you're a top analyst in the first place - because you would understand the insights extracted from an AI copilot.

What is your opinion on this topic?